Study based on 2016-17 data puts city at low risk ‘overall’ but at high risk for revenue trends

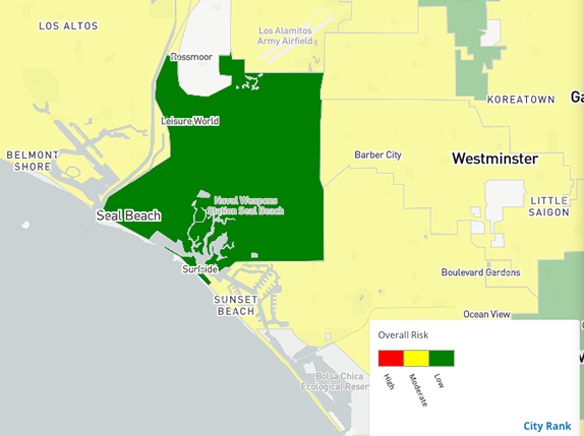

Seal Beach is at low risk for “financial distress” overall, according to a recent survey released by the California State Auditor’s office.

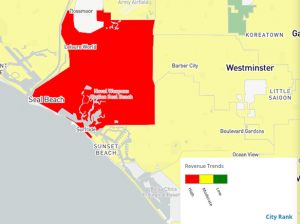

However, the Seal Beach was ranked at “high risk” for revenue trends and at “moderate risk” for pension obligations, according to the State Auditor’s website.

“The fact that Seal Beach is more fiscally responsible than most other California cities does not surprise me,” wrote Mayor Thomas Moore in a Nov. 5 email to the Sun. “We have good fiscal discipline by having a diligent City Council and City Staff that is very careful how money is spent. Each council member looks very closely at the budget and has made wise decisions in the past 3-4 years to ensure the long-term stability of the City. The City Council and City Staff worked hard during the past budget cycle to try to keep a realistic view of the next few years and the council working with staff was able to reduce spending for both the General Budget and the Capital Improvement Program. Also, I appreciate the residents that watch the budget and ensure the Council is made aware of items that might normally get overlooked,” Moore wrote.

“It is healthy to be fiscally cautious so that everyone in Seal Beach can feel confident of the long-term stability of the City,” Moore wrote.

Addressing the pension issue, Moore wrote, “I would add that pension obligations have always been a concern to me and that we include that the City Council will be discussing this at our strategic planning session early next year as part of our 3 to 5 year budget forecasts going forward.”

Seal Beach ranked 362nd overall out of 471 cities surveyed for financial risk, putting Seal Beach among the cities classified as “low risk” for financial trouble. According to the state agency’s criteria, the lower your ranking, the lower the risk. For example, Compton ranked no. 1 out of 471 cities, in large part due to what the State Auditor’s website described as a lack of transparency.

The state agency ranked Los Alamitos at moderate risk overall. However, Los Al ranked no. 1, “high risk” for future pension costs.

Rossmoor is an unincorporated area and was not included in the rankings. The State Auditor’s Office recently ranked California cities by financial risk. (Details are available online and the report includes an interactive, color-coded map.)

The study was based on 2016-2017 data from 471 cities that published audited information based on “generally accepted accounting practices.”

The State Auditor assessed California cities based on a variety of criteria, including liquidity (having enough cash to pay its bills) a city’s debt burden versus its income, financial reserves, revenue trends, and retirement obligations.

The State Auditor’s study considered pension costs, but apparently not operating costs. The State Auditor’s study ranked cities by individual category as well as overall financial position. Details below:

Revenue trends

For revenue trends, Seal Beach ranked 46th, placing the beachside town among 65 cities classified as being at “high risk” based on revenue (income) trends. “This designation indicates that a city’s general fund revenues are flat or declining, which could strain its ability to maintain service levels, especially in times of rising costs,” according to the State Auditor’s website.

The State Auditor’s Office looked at revenue trends by calculating the “average annual change in general fund revenues from fiscal year 2014-15 through 2016-17.”

According to the figures posted on the State Auditor’s website, Seal Beach’s average annual change in general fund revenues was minus 1% a year. “In regards to future revenue trends, the data is prior to the measure BB passing and is missing a few growth years for Seal Beach, so I anticipate this to be adjusted in the near future once more data is collected,” Moore wrote.

In 2018, the Seal Beach City Council placed Measure BB on the ballot to increase the sales taxes 1 cent. The ballot measure cited a need “to offset significant budget cuts and state takeaways and maintain City services” in asking voters if they would approve a 1 percent sales tax.

Voters approved the sales tax increase, which went into effect in April.

Pension obligations

For pension obligations, Seal Beach ranked 129th, placing the city at “moderate risk” according to the survey. “This designation indicates that a city’s unfunded pension obligations represent a substantial portion of its annual revenues; therefore, making required contributions to the plan(s) may strain the city’s financial resources,” according to the website.

Other criteria

• For liquidity, Seal Beach ranked 91. (The State Auditor put Seal Beach among the cities at low financial risk in the “liquidity” category. “This designation indicates that a city’s general fund has cash and investments at fiscal year-end in an amount that substantially exceeds its short-term liabilities,” according to the State Auditor’s website.) Seal Beach was among 410 cities (out of 471) at “low risk” in this area.

In all, 87% of the cities in the survey were ranked at “low risk” for liquidity issues, including Los Alamitos.

• For debt burden, Seal Beach ranked 314th. This ranking put Seal Beach among 214 cities classified as low risk based on their debt burdens. Los Alamitos was also among the cities classified as “low risk” for debt.

• For General Fund reserves, Seal Beach ranked 352nd. Los Alamitos ranked 270th for reserves.

• For pension funding, Seal Beach ranked 217th, putting the city at “moderate risk.” “This designation indicates that a city’s pension plan(s) is not fully funded but has enough assets to fund a moderate portion of the pension benefits earned by its employees,” according to the website.)

• For pension costs, Seal Beach ranked 320th, placing the city among 257 seven cities—54% of those surveyed—that the State Auditor’s survey found were at “low risk.”

Los Alamitos was ranked 28th, placing it among 51 cities at high risk.

• For future pension costs, Seal Beach ranked 113th, which put the city among 224 cities at “high risk.”

Los Alamitos ranked no. 1 for future pension costs.

To see the State Auditor’s study, visit https://www.bsa.ca.gov/bsa/cities_risk_index.